Some Known Questions About Bankruptcy Attorney Tulsa.

Some Known Questions About Bankruptcy Attorney Tulsa.

Blog Article

An Unbiased View of Bankruptcy Law Firm Tulsa Ok

Table of ContentsThe Facts About Chapter 7 - Bankruptcy Basics UncoveredSome Ideas on Tulsa Ok Bankruptcy Specialist You Need To KnowThe 15-Second Trick For Bankruptcy Law Firm Tulsa OkTop-rated Bankruptcy Attorney Tulsa Ok Can Be Fun For AnyoneLittle Known Questions About Chapter 7 Vs Chapter 13 Bankruptcy.The 15-Second Trick For Bankruptcy Law Firm Tulsa Ok

People should make use of Chapter 11 when their debts exceed Phase 13 financial debt restrictions. It hardly ever makes sense in other circumstances yet has a lot more choices for lien removing and cramdowns on unprotected parts of protected loans. Phase 12 bankruptcy is made for farmers and anglers. Phase 12 repayment plans can be extra adaptable in Chapter 13.The methods test looks at your typical regular monthly income for the 6 months preceding your filing day and compares it versus the average earnings for a similar family in your state. If your earnings is below the state median, you immediately pass and do not need to complete the whole type.

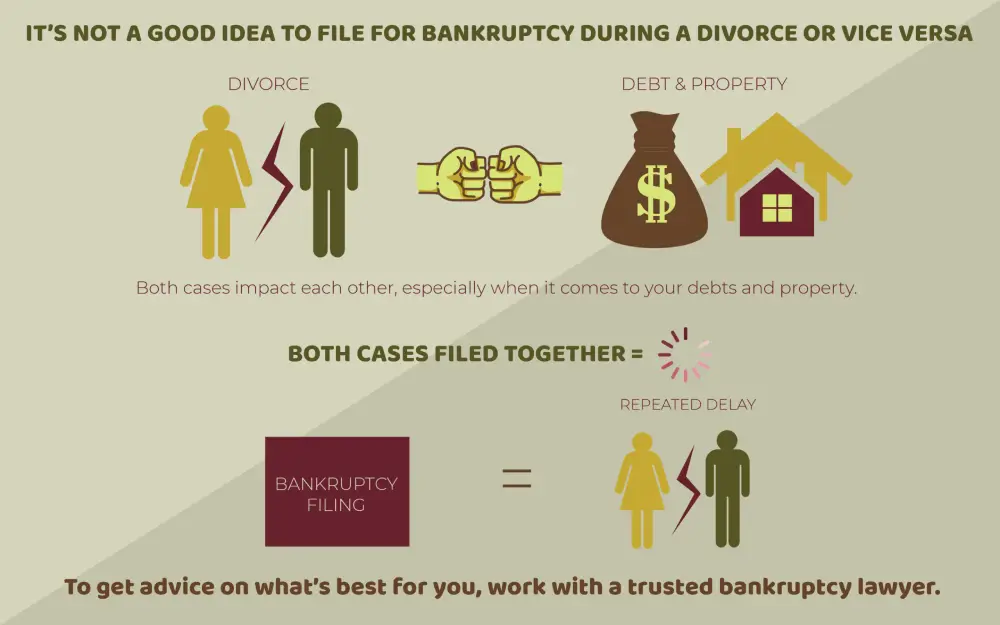

The financial debt restrictions are noted in the graph above, and current amounts can be validated on the United State Judiciaries Phase 13 Personal bankruptcy Essential page. Find out more concerning The Method Examination in Chapter 7 Insolvency and Financial Obligation Limits for Phase 13 Insolvency. If you are married, you can file for personal bankruptcy collectively with your partner or separately.

Declaring personal bankruptcy can help an individual by disposing of financial debt or making a plan to pay back financial obligations. A bankruptcy case generally begins when the debtor files an application with the bankruptcy court. A request might be filed by a specific, by spouses together, or by a firm or other entity. All insolvency cases are handled in federal courts under rules outlined in the U.S

The Only Guide for Tulsa Ok Bankruptcy Specialist

There are different kinds of bankruptcies, which are normally described by their phase in the U.S. Personal Bankruptcy Code. People might submit Phase 7 or Chapter 13 bankruptcy, depending upon the specifics of their scenario. Municipalitiescities, communities, towns, straining areas, municipal energies, and college areas might file under Phase 9 to rearrange.

If you are encountering monetary obstacles in your individual life or in your organization, possibilities are the concept of declaring insolvency has actually crossed your mind. If it has, it likewise makes good sense that you have a great deal of insolvency concerns that require solutions. Many individuals actually can not respond to the concern "what is insolvency" in anything except general terms.

If you are encountering monetary obstacles in your individual life or in your organization, possibilities are the concept of declaring insolvency has actually crossed your mind. If it has, it likewise makes good sense that you have a great deal of insolvency concerns that require solutions. Many individuals actually can not respond to the concern "what is insolvency" in anything except general terms.Lots of people do not recognize that there are several sorts of bankruptcy, such as Phase 7, Phase 11 and Chapter 13. Each has its advantages and challenges, so knowing which is the most effective choice for your existing situation along with your future recuperation can make all the distinction in your life.

Not known Facts About Tulsa Bankruptcy Filing Assistance

Phase 7 is labelled the liquidation bankruptcy chapter. In a chapter 7 personal bankruptcy you can eliminate, wipe out or release most sorts of financial obligation. Instances of unsafe financial obligation that can be eliminated are bank card and medical bills. All sorts of people and firms-- individuals, couples, firms and partnerships can all file a Chapter 7 bankruptcy if eligible.

Several Phase 7 filers do not have much in the means of possessions. They might be renters and possess an older car, or no cars and truck in any way. Some cope with parents, good friends, or siblings. Others have homes that do not have much equity or remain in severe demand of repair work.

The amount paid and the period of the plan depends on the borrower's home, median income and expenditures. Financial institutions are not permitted to go after or preserve any type of reference collection activities or claims during the situation. If effective, these financial institutions will be eliminated or released. A Chapter 13 insolvency is really powerful since it gives a system for debtors to stop foreclosures and constable sales and stop repossessions and utility shutoffs while capturing up on their protected financial obligation.

Not known Factual Statements About Top-rated Bankruptcy Attorney Tulsa Ok

A Chapter 13 instance may be useful in that the debtor is allowed to get caught up on home loans or vehicle loan without the risk of foreclosure or foreclosure and is permitted to maintain both excluded and nonexempt property. The borrower's strategy is a document outlining to the bankruptcy court exactly how the borrower proposes to pay current expenditures while paying off all the old debt equilibriums.

It provides the borrower the opportunity to either offer the home or become caught up on home mortgage payments that have actually dropped behind. A person filing a Phase 13 can recommend a 60-month strategy to heal or come to be present on home loan repayments. For instance, if you fell back on $60,000 worth of home loan settlements, you could recommend a strategy of $1,000 a month for 60 months to bring those home mortgage settlements present.

It provides the borrower the opportunity to either offer the home or become caught up on home mortgage payments that have actually dropped behind. A person filing a Phase 13 can recommend a 60-month strategy to heal or come to be present on home loan repayments. For instance, if you fell back on $60,000 worth of home loan settlements, you could recommend a strategy of $1,000 a month for 60 months to bring those home mortgage settlements present.The Ultimate Guide To Experienced Bankruptcy Lawyer Tulsa

Occasionally it is much better to stay clear of personal bankruptcy and settle with financial institutions out of court. New Jacket additionally has an alternate to insolvency for services called an Job for the Advantage of Creditors and our legislation company will certainly discuss this alternative if it fits as a prospective technique for your business.

We have created a tool that aids you pick what chapter your file is most likely to be filed under. Click on this link to make use of ScuraSmart and discover a feasible solution for your debt. Numerous individuals do not understand that there are several kinds of personal bankruptcy, such as Chapter 7, Phase 11 and Chapter 13.

Here at Scura, Wigfield, Heyer, Stevens & you can check here Cammarota, LLP we handle all types of insolvency instances, so we are able to address your bankruptcy concerns and help you make the most effective decision for your situation. Right here is a brief check out the financial obligation alleviation choices readily available:.

Some Of Chapter 7 - Bankruptcy Basics

You can just submit for bankruptcy Prior to declaring for Phase 7, at the very least one of these should be true: You have a lot of financial obligation revenue and/or possessions a creditor can take. You have a lot of financial debt close to the homestead exception quantity of in your home.

The homestead exception amount is the higher of (a) $125,000; or (b) the county median sale rate of a single-family home in the coming before fiscal year. is the amount of money you would maintain after you marketed your home and paid off the home loan and various other liens. You can find the.

Report this page